Raising a kid is an adventure. Nothing, no matter how many books, parenting forums, or articles you read, can fully prepare you for it. Nothing transforms your life like the arrival of a new baby. You might be experiencing a range of feelings, from excitement and delight to uneasiness and even full-blown dread.

Not to mention the burning issue on the minds of many new parents: “How much money should I have saved before having a baby?”

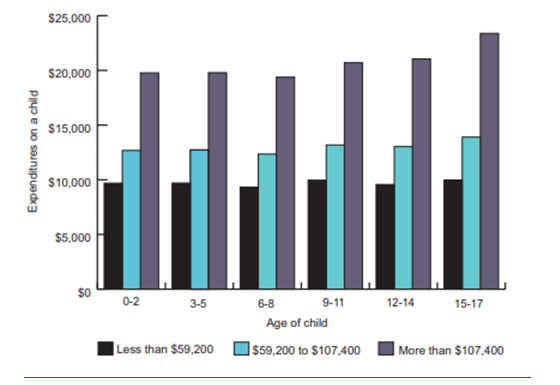

While the USDA estimates that a middle-income family will spend an average of $233,610 raising a kid from birth to age 17, don’t let this six-figure price tag scare you. The fact is that financially preparing for a kid requires some forethought, but you have time before and after your baby comes to ease the financial transition into parenting.

However, like with planning to purchase a home, it may be a good idea to get your financial circumstances in order before deciding to bring a child into this world. It is better to immediately create a financial plan for yourself and strictly adhere to it so that later you do not torment yourself with the same thought – “I need money now to ensure the well-being of my child.” When you have children and are experiencing financial challenges, you must work to better your financial condition and do proper accounting. Here are some financial goals to set before having children.

Creating a general emergency savings fund is a good strategy to ensure you have a financial safety net in place to safeguard your family from unforeseen expenditures. The general rule of thumb among financial advisors is that an emergency fund should cover three to six months of living costs. If that’s not possible, strive for a minimum of $1,200.

Have Enough Disposable Income

To most people, $233,610 is a lot of money. When boiled down to $1,082 each month, though, it makes a lot of sense. Calculate the projected yearly expenditures of raising a kid and include them in your budget so that you are prepared when the charges arrive.

The following financial milestone assists you in fine-tuning your wages and other elements that may impact your circumstance. This will also tell you how much discretionary money you’ll need to raise your children. Furthermore, it guarantees that you have enough resources to cover predicted variable expenditures.

For clarity, you can look at the graph of average family expenditures on a child, by income level and age of the child.

Maintain a Stable Career

It is critical to have a stable job before becoming a parent. While this might mean regular work, self-employment, or a mix of the two, you want a solid foundation to support your expanding family.

Attempt to explore professional choices that will allow you to continue working once your children are born or adopted. Also, aim to obtain a wage that will cover the cost of child care if necessary. According to the United States Department of Agriculture, this may equal around 16% of the entire expense of raising a kid.

However, there is more to consider than simply income. Consider a job that provides advantages such as parental leave and health insurance. Also, search for a reasonable personal/sick leave policy so that taking a day off to care for a sick kid does not result in a day’s salary loss.

Pay Off Your Debts

Americans aged 18-34 have an average debt of $36,000 and devote 34% of their monthly income to debt repayment. Education loans and credit card bills are the primary sources of debt for many millennials. You’re probably concerned about money and debt if you’re expecting a child.

If you can pay off part or all of your debt before the kid arrives, that’s fantastic! Whether or not you want to pay off your credit card or other debt, pay at least the minimum amount on time each billing cycle to keep your credit in good standing. Then calculate how much you’ll need to save to financially sustain a baby.

Determine your baby supply budget, add the amount needed to cover any maternity or paternity leave then divide that total by the number of months until the baby comes. Then, look at how much money is left over each month to pay off debt quicker.

Have the Ability to Save for College

Many individuals have false expectations about what it will take to cover the (increasing) expenses of education. Every year, the student loan debt situation deepens, and there is little sign that it will improve anytime soon.

The greatest method to reduce the financial load you and your future children will experience when they reach college age is to plan ahead of time. If you start saving for your children’s college education as soon as possible, you’ll put them ahead of the pack—at least monetarily.

Make a Contribution to Your Retirement.

As your children get older, the expense of parenting them will rise. As a result, your next financial goal should be to prepare for retirement so that your future is safe and independent before having children. When you have children, it becomes more difficult to contribute to your retirement savings since additional costs will undoubtedly arise.

Consider Child Care in Advance

Child care is the most significant new expense for most households (or the income adjustment of having a parent opt to stay home). Finding excellent care while still making finances meet is a significant barrier for families.

If you anticipate requiring child care beyond what family members can supply, you should begin exploring possibilities or making adoption plans as soon as you receive a positive pregnancy test. Daycare facilities may quickly fill up or maintain a long waiting list, so getting started early is usually a smart idea.

Families that cannot afford exorbitant daycare rates sometimes rely on a combination of family and alternative care alternatives. Grandparents are a common source of care, with 38% of grandparents working as babysitters or daycare providers. Home-based care facilities are often less expensive than conventional daycares.

Conclusion

Ideally, you’ll be able to complete these tasks before becoming a parent. However, you should keep in mind that they reflect the best-case situation. If you can’t cross all of these items off the list, it doesn’t imply you shouldn’t become a parent or that you’ll be bankrupt if you do. Instead, let them serve as targets to be aware of and strive towards. The more of these milestones you can complete before having children, the less financial stress you’ll have to deal with while raising kids.

Related Posts