Debt. It’s as American as apple pie.

Consumer debt in this country will top a whopping $1 trillion by year end. For many, it’s a crushing burden that’s nearly impossible to escape.

Make only the minimum payment on a high-interest credit card? It can take decades until the debt is whittled down to zero. Plus, carrying a hefty balance erodes good credit — and peace of mind.

That’s where Greenlink Financial comes in. With a deep bench of financial expertise that is matched only by its reputation for integrity, the Irvine, Calif.-based private lender has provided financial know-how to countless financially-struggling consumers since its start only four years ago.

By focusing on turning consumers into repeat customers, Greenlink has enjoyed explosive growth, leap-frogging to No. 334 on the 2018 Inc. 5000 list of the nation’s fastest growing private companies. The firm’s rate of revenue growth over the last three years has hit an eye-popping high of nearly 1,500 percent.

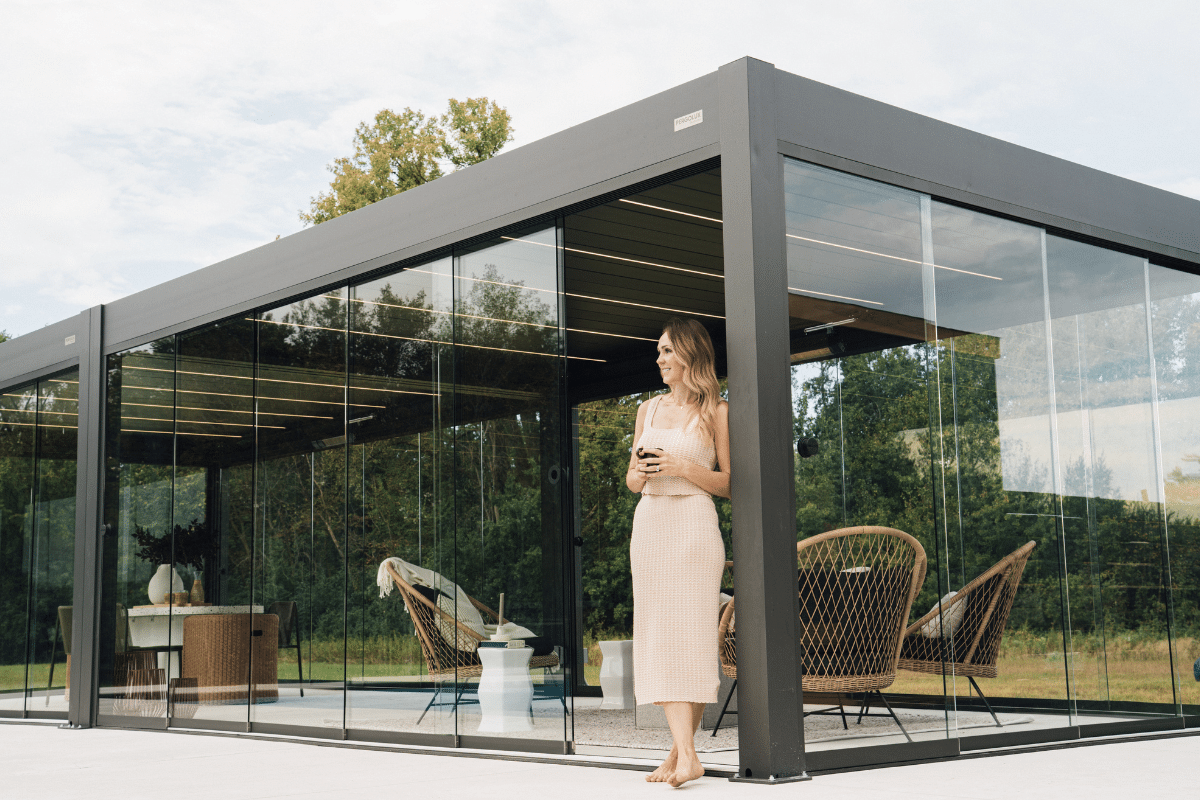

Greenlink Financial CEO Eric Heller (California Business Journal) And that’s the just the beginning. California Business Journal caught up with CEO Eric Heller as he was racing off to celebrate a new victory: a record-breaking year by two top employees.

“Last month we had two agents approve more clients than any agent in the United States in the last 20 years,” he remarks. “It felt pretty good.”

And while Heller is quick to praise his employees, and relishes the national spotlight focused on the young company, he’s mindful that its success was built on a forward-looking formula: take time to create a lasting bond with each and every customer.

That’s what sets Greenlink Financial

“For the competition, it’s just business. Most companies don’t think about tomorrow,” Heller says. “We always think of tomorrow.”

Greenlink’s focus on the future begins when an agent picks up the phone to go over an application with a customer. The typical client, Heller says, is saddled with around $25,000 in credit card debt.

“They’re nearing their 50 percent limit and have been carrying it for two to three years,” Heller explains. “The bottom line is they’re not getting anywhere.”

The initial phone conversation is the start of a relationship — not just a financial transaction, as Heller is quick to point out. And while agents dig into the typical questions you’d expect — personal finances, credit history, income — they also ask broader questions about the client’s hopes and dreams, including, “Where do you see yourself in five years? What are your savings goals?”

“It’s not just judging a client based on their credit score and their income, it’s getting to understand the consumer’s financial goals,” Heller says. “Their financial goals may be to retire in a certain amount of years, restore their savings account to a certain amount of money, get a swimming pool, put their child through college, things like that. Once you understand their financial goals, then we start saying, ‘Ok, let’s put a plan together to achieve these goals.’”

The plan starts with custom-fit solution to pay off credit cards and free the customer from debt. “Our company is an expert in how to reboot credit card debt by spending the least amount of money in the shortest amount of time,” he says.

And by working with many lenders nationwide, the company offers a selection of loan programs with low payments. The typical customer pays off their debt in five years or less, Heller says.

Greenlink Financial’s personalized approach is not only a huge benefit to customers, Heller maintains that it has sharply reduced the firm’s overall spending on marketing. Nearly one-third of the firm’s customers come from referrals — a remarkable number in an industry where the norm is two percent or less.

“When you take the time to understand people’s needs, you gain people’s trust, where they end up coming back to you,” he explains. “Over the last four years, we’ve seen our company double, and it’s not necessarily because of marketing, it’s because of referrals and repeat customers.”

By establishing a baseline of trust, even the clients the company initially can’t help end up coming back, Heller notes.

He says it just makes sense.

Business is now so good that Heller says the company can hand-selected new hires, and routinely recruits among individuals referred by current staffers. Once hired, employees go through an in-depth week-long training program.

“The nice thing about our company is you can be a truck driver, but if you like the culture and you have certain attributes that we feel that will be successful and a positive influence to our company, we’ll take you through the rigorous training — if you’re willing to go through it all, and hungry enough, and smart enough to handle what we do. We’ll take someone who knows nothing about the industry and convert them into a high-level salesperson.”

Looking forward, Heller expects to expand to firm’s product offerings to include mortgages and student loans. But right now, he is enjoying the moment. And he’s got no more time to talk — he’s got a party to get to, to ring in another record-breaking month.

Copyright © 2018 California Business Journal. All Rights Reserved.