When workers’ compensation insurance premiums were soaring to unfathomable levels for Phil Larios’ real estate development company, he was seriously considering restructuring his payroll and cutting employees’ salaries to compensate for the unexpected rise in insurance costs.

But then he discovered a unique insurance platform that could cut his insurance costs – including workers’ compensation – by up to 60 percent. This fascinating form of insurance – which is the polar opposite of the traditional and volatile insurance market — is called Group Captive insurance and one of the national leaders in this area is Owen-Dunn Insurance in Sacramento, California.

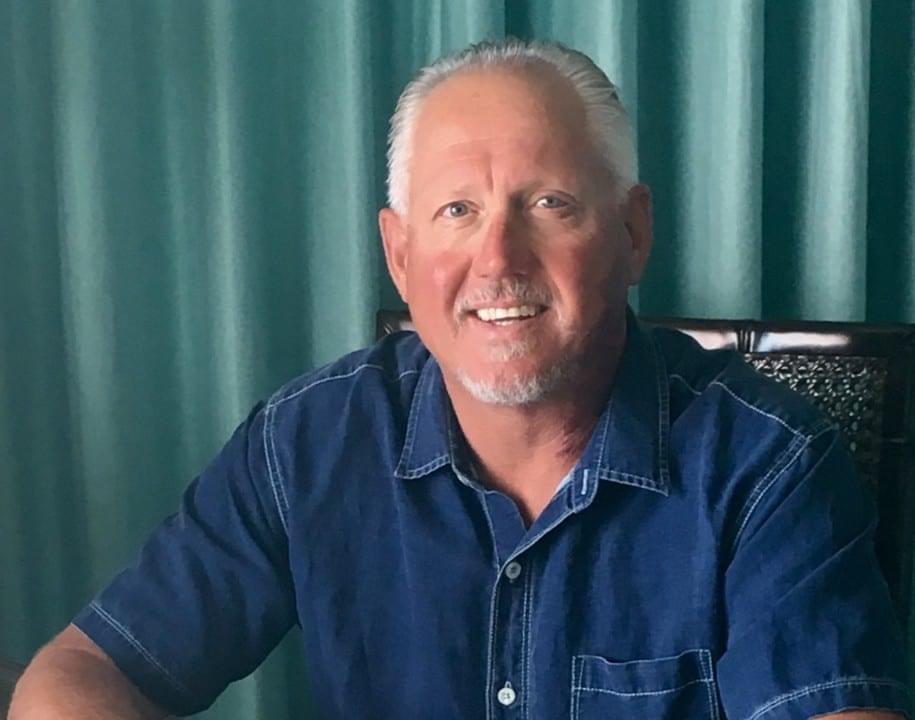

Larios’ firm, The Hignell Companies, is a real estate development and management company in Chico, California. Larios was introduced to Group Captive insurance 14 years ago by Owen-Dunn. He saved $300,000 the first year in insurance costs – and every year since. That equates to more than $4 million overall.

“Back in 2003, our workers’ comp was $875,000 alone annually and headed to $1 million the following year,” Larios says. “At the time, we had 180 employees. It would have been very difficult to survive with that $1 million workers’ comp number. We would have had to do some pretty good adjustments on payroll to make it work. We would have had to change our business structure.”

But because of the Group Captive insurance program proposed by Owen-Dunn, Larios’ company survived and is thriving like never before. “It was a life saver,” he says.

What makes the Group Captive platform even more attractive is that unused insurance premiums roll over into an equity account, which has earned returns of nearly six percent over the last 20 years, according to Tim Dickison, the Captive Department Director at Owen-Dunn.

Because of all the benefits, there is serious growing demand for Group Captives … so much so that Owen-Dunn recently launched a separate Captive division (www.odigroupcaptive.com) and is now targeting mid-size businesses outside of California.

“We focus on Group Captive insurance – and have increased that focus – because we figured out many years ago that it was the right thing to do for our clients,” Dickison says.

“It saves our clients more money than any other product that we could provide them. It is the best option in the marketplace for companies that are focused on employee safety and keeping their claims to a minimum. And we like the transparency of it — our clients know where every single penny of every dollar of their insurance premiums goes.”

Group Captive insurance most benefits companies with fewer claims than their industry average. This is why Owen-Dunn’s focus is on mid-size companies that are well run, financially stable, safety conscious and value their employees. Then, once the company is properly vetted, Owen-Dunn identifies the Group Captive of like-minded companies that is likely to provide them the greatest cost savings so they can turn a portion of their premium expense into an asset.

Group Captives are structured so that 60 percent of premiums are held in the member companies’ interest-earning asset accounts to cover the cost of any claims that arise. When a member company’s claims are less than what was held in the asset account, the premiums are returned in the form of dividends. The remaining 40 percent of premiums covers the cost of reinsurance for catastrophic claims as well as the general costs of running the Captive.

Over the last 20 years, Owen-Dunn has placed approximately 115 companies into Group Captive insurance. The list is growing daily. Collectively, the 115 companies have amassed over $50 million in equity that would otherwise have gone to their former traditional insurance carriers.

The demand for Group Captive insurance is so strong because companies are “fed up” with rising insurance costs – even when they have been successful in keeping claims to a minimum.

The benefits of Group Captive insurance are overwhelming: not only does it enable companies to turn a portion of their premiums expense into an asset by building equity through their insurance expense, but it gives them a competitive advantage over their competitors.

For instance, Owen-Dunn has a client that pays less than $1 per 100 people for workers’ compensation. That client’s competitor, which is only three miles away, is likely paying $10 per 100 for its workers’ comp.

“That’s because they have more claims and they’re in the standard insurance market, where companies do not receive any benefits from reducing their number of claims,” Dickison says.

Owen-Dunn is one of the few – and perhaps the only — insurance agency that features its own Group Captive division with a dedicated staff of six salaried insurance experts whose sole job is to reduce clients’ risks and mitigate their claims … when they have them. Dedicated Human Resources, Loss Prevention, and Claims Management professionals are available to every Captive client to ensure each company’s success in the program.

Few other insurance brokerages that offer Group Captive insurance have any client services representatives dedicated solely to the department.

“That’s what places Owen-Dunn head and shoulders above other insurance brokerages,” Larios says. “To me, they’re unquestionably the go-to company for Group Captive insurance. I know. That’s why we’ve been with them for 14 years.”

Owen-Dunn Insurance Services

1455 Response Rd., Ste. 260

Sacramento, CA 95815

916.993.2755

Chances are, if you’re working with data, you’re using apps and other software services to…

A new report from the United States of Care (USofCare) has spotlighted the healthcare affordability…

Innam Dustgir's journey from freelancing to becoming the CEO of three highly successful IT companies…

California has a big vision for the future of clean energy. This year, renewable energy…

The loss of a tooth can affect more than just your smile—it can impede on…

Imagine a young mother of two suddenly loses her husband in a tragic accident. The…