Online payments have become a norm, especially in New Zealand online gambling. With the many payment processors available, finding the right one for you can sometimes be challenging. Still, the choice becomes easier with the right information.

Prezzy Card as a casino payment option has hit the gambling world, promising to provide fast and convenient payments for all of its users, but is it a good option? We appreciate John Gold from BetPokies for providing the information we needed to write this article.

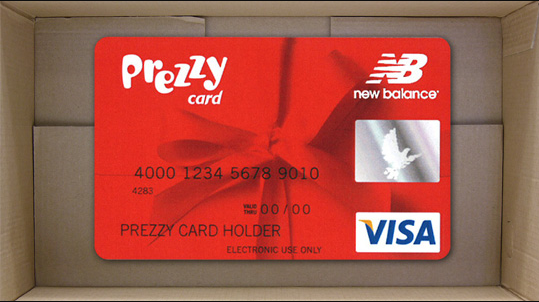

Prezzy Card is a prepaid Visa and Mastercard payment option launched in 2006 by ePay. Prezzy Card eliminates all the problems associated with traditional credit cards while allowing users to make purchases in regular or online stores that accept Visa or Mastercard.

Depending on your preferred option, New Zealanders can order a Prezzy Visa or Mastercard and receive it through email or courier. After that, you must unlock and register the card before using it for deposits.

If you received it through email, you can unlock it through an activation link through the same email or visit the official site if you received the card through courier delivery. If someone got it for you as a gift, they must provide a 4-digit activation code which you can use to register and activate the card. Once you get to the site, navigate to unlock the card and fill in the required details.

A couple of limitations are associated with the card regarding where and how you can make payments. The card will not work in ATMs or manual card imprinters. You also cannot use it in automated fuel dispensers or pay for taxis.

You can however use the card to make deposits at online casinos, but you can only withdraw your cash by using a different payment provider. It also does not support direct debits, payment installments, and recurring payments.

There are not any considerable differences between the two cards. You can use any of the two globally if they are accepted. It is worth noting that Oxygen Global issues the Prezzy Card Visa, but it is not the owner and does not control the card’s daily operations. When using the two cards, you can check your balance and transaction history in two ways:

Prezzy card has five types of fees you need to be aware of:

Every person has their preferences, and sometimes what works for you may not work for another person. However, looking at the pros and cons may give you better information about what to expect if you sign up for a Prezzy Card.

If you are looking for a payment option worth considering at New Zealand online casinos, then Prezzy Card may suit your needs. You should note that you can only use it to make deposits. Also, when the card expires, you lose all your money.

Gambling can be very addictive. If you are experiencing gambling addiction, please contact the gambling helpline at 0800 654 655.

Innam Dustgir's journey from freelancing to becoming the CEO of three highly successful IT companies…

California has a big vision for the future of clean energy. This year, renewable energy…

The loss of a tooth can affect more than just your smile—it can impede on…

Imagine a young mother of two suddenly loses her husband in a tragic accident. The…

California, known for its diverse economy and thriving tech industry, is a hotbed for innovation.…

As a violinist, I can't stress enough how crucial a top-notch case is in the…