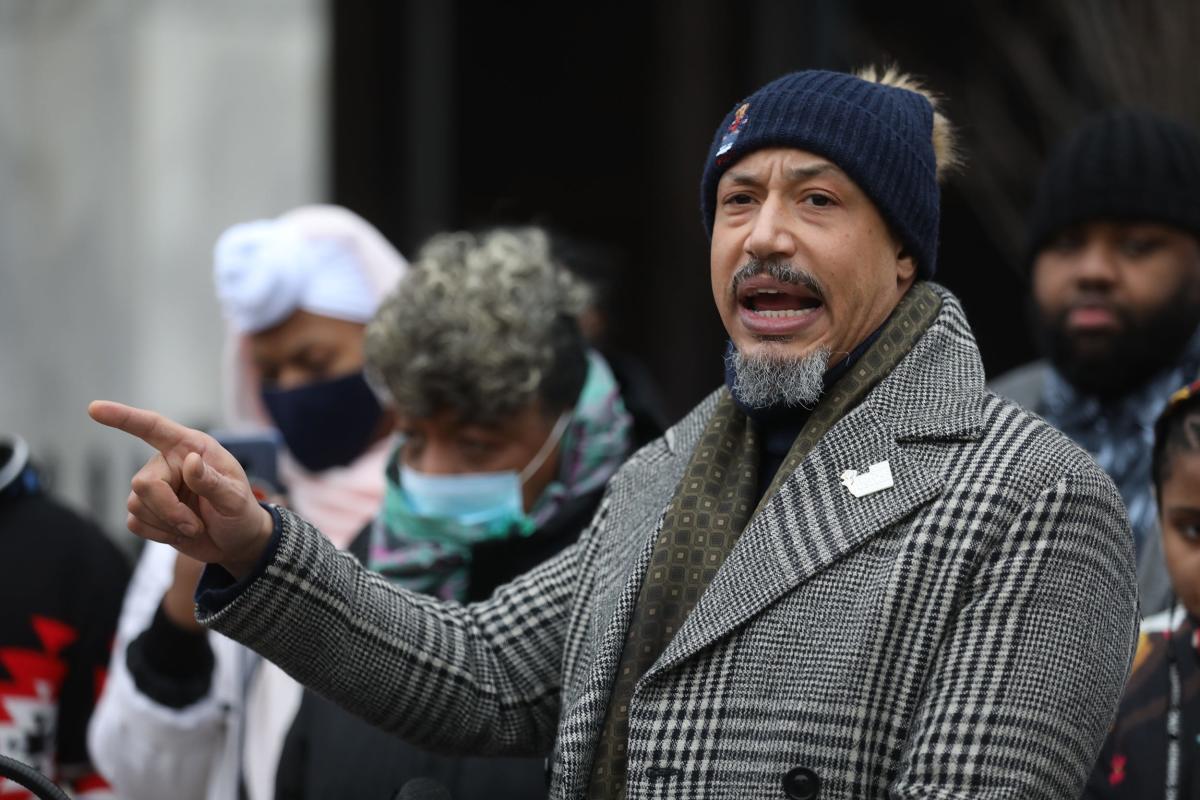

Kristen John Foy

This fall will mark 12 years since I was a victim of police brutality. The incident not only left me emotionally and physically scarred, but also exposed me to the vagaries of a booming industry that preys on the injured and indebted: lawsuit lending.

In September 2011, my best friend and I were handcuffed, detailed, and roughed up at the annual Brooklyn West Indian Day Parade. Though the police commissioner publicly apologized after the fact and admitted his officers were wrong, the damage was done. I had a fractured kneecap, a torn ligament, and a rotator cuff injury – all of which required surgery to repair.

I wanted justice, so I took the only avenue of recourse available: I sued.

As I awaited the outcome of my federal lawsuit, my medical bills and living expenses piled up. I had a wife and new baby and could not work because of my injuries. My lawyer introduced me to the concept of lawsuit lending – borrowing against an expected settlement or judgment.

I needed the money. I took out multiple loans even though I didn’t really understand the terms, which included an interest rate that compounded monthly. As a result, when I settled my case in November 2014 for $225,000, I owed just under half of that to the lender.

Actually, I was lucky. Though my lawyer required me to sign a statement claiming he had advised me against a lawsuit loan – even though he introduced me to the lender – he stepped in at the end and negotiated down the amount I owed. Many others are forced to use most or all their legal winnings to pay off their lenders. Some end up in debt, even after they die.

This is happening because the lawsuit lending industry is entirely unregulated. Loans such as these can actually be very beneficial for those that suffer a set back and need help financially. However, just like most industries, lawsuit lending would benefit from commonsense reforms. Reforms will preserve an important revenue stream for underbanked or unbanked borrowers while protecting them from the unfortunate existence of unscrupulous lenders.

This can be accomplished through SB 581, introduced by Sen. Anna Caballero and supported by Consumers for Fair Legal Funding – CA (CFLF-CA), which I am proud to represent.

Due to a legal technicality, lawsuit loans are considered “investments” called “non-recourse funding” and are not regulated like traditional loans. That means lenders can – and do – charge as much interest as they want. According to a 2020 study, the average profit on a lawsuit loan is 60%, though some borrowers have paid 100% in annual interest, or more.

Lawsuit lenders maintain that they are providing a lifesaving financial investment and thus require fair compensation for their investment in any given case. However, unfortunately, bad actors often generate the most attention and take advantage of those in need.

Lenders also don’t have to disclose lawsuit loans within the context of the litigation process, making it impossible to know if anyone involved has a financial conflict of interest. Opponents argue that disclosure would negatively impact plaintiffs, by potentially driving down the dollar amount of settlements or jury awards. But there is no evidence of that in the growing number of states and courts – including two in California – that have enacted reforms.

Lenders, often backed by rich hedge funds or foreign investors, claim that they’re taking a financial risk because borrowers don’t have to pay back lawsuit loans if they don’t settle or win their cases. But in a recent 60 Minutes expose, the CEO of Burford Capital, the world’s largest litigation funder, admitted that his company regularly doubles its money on 90% of cases in which it invests.

That’s an incredible rate of return. It also explains why the lawsuit lending industry is booming, reportedly growing an eye-popping 414% nationwide between 2013 and 2017. That profit is largely being made on the backs of vulnerable Californians, particularly members of Black and brown communities who are more likely to be operating without a sound financial safety net.

I hope my story serves as a cautionary tale for California state lawmakers and moves them to vote “yes” on SB 581. A lawsuit loan can be a lifeline for vulnerable plaintiffs, but they should not be victimized twice – first by the injustice that spurred them to sue and then again by a lender who is only looking out for a profit. SB 581 puts guardrails around the industry, while preserving its ability to help those in financial need. It should become law without delay.

Kirsten John Foy is president and CEO of The Arc of Justice, a national social, economic, and environmental justice advocacy organization with three chapters in California: Los Angeles, Sacramento, and San Diego. He is also the spokesman for Consumers for Fair Legal Funding – NY.

As a violinist, I can't stress enough how crucial a top-notch case is in the…

Imagine a life where limitations do not exist—a life where you relentlessly pursue your dreams…

Asbestos exposure has left a long legacy of health issues in Australia, particularly mesothelioma and…

Did you know maintenance and financing, fuel management, driver management, vehicle monitoring and diagnostics, and…

It can be difficult to meet a matching spouse in this fast-paced environment. Online dating…

The interior design industry has become increasingly popular in recent years as people seek homes…