With the price of real estate rising by leaps and bounds every second, renting is the only way people are managing to live in countries as costly and popular as the States. California is one of the busiest states here.

Thousands of people come here either in search of a job, or for studying.

Needless to say, because of the excessive demand, they have a hard time finding a suitable apartment for them. Even after finding the apartment, the job isn’t over.

Renters insurance provides a renter adequate safety and insurance to live in a place where cost of replacement surges much higher compared to the rent of the house you live in.

California has some of the most strategically important places. Starting from Los Angeles to Sacramento, the renters insurance provides enough cover to protect renters from issues that can arise from staying in renter’s accommodation. San Diego attracts students from all over the world every year, San Francisco is the hub for tech workers, and the recent popularity of Silicon Valley has made these places very important for people looking for jobs and also houses.

Undoubtedly, getting the proper house, and the perfect landlord isn’t an easy job. It requires a lot of research, networking, the assurance of not getting evicted just when some peril hits home.

Tenants don’t stay at their own houses, and are at risk of being evicted any moment. The tenant laws and insurance of whatever they possess can help them out. Renters insurance is necessary for these people as well. To be honest, people who don’t own much property, are not likely to have enough cash to replace their stuff when an emergency arises. To get proper coverage in those times of need, the renters insurance comes in handy.

The common misconception is that only because the personal property doesn’t cost much, there won’t be enough coverage for it. However, a piece of property is your usable property nonetheless. It’s cheap price or its archaic manufacturing won’t make it anything less than that.

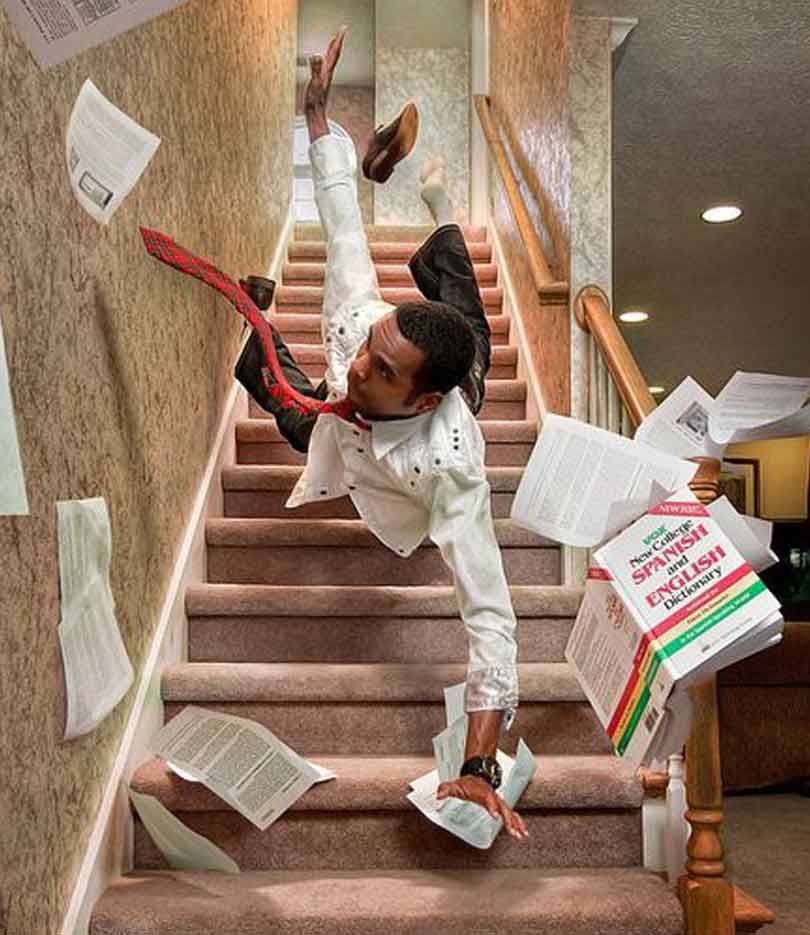

Dangers can come from any direction and we don’t really have many options after they have fallen upon us. The insurance acts as a cushion to protect us in those days. A sudden fire or water emergency can make your house inhabitable, won’t it? Ever thought about what you would do under those circumstances? That is where the insurance comes in. It covers all the costs of your accommodation if the damage is under the list of covered risks.

Here’s good news. Despite the ever rising popularity of this state, the renter’s insurance in California is affordable. The average cost for someone residing in this state is around $200 per year. If your lucky stars align, more discount coupons would find their way to you.

The discount programs are also different in different companies and they are tailor made for various kinds of consumers.

The best part with renters insurance is, it has something for everyone. Your needs, amount of personal property you own and the place you live help in shaping up the perfect renters insurance plan suited for you.

Innam Dustgir's journey from freelancing to becoming the CEO of three highly successful IT companies…

California has a big vision for the future of clean energy. This year, renewable energy…

The loss of a tooth can affect more than just your smile—it can impede on…

Imagine a young mother of two suddenly loses her husband in a tragic accident. The…

California, known for its diverse economy and thriving tech industry, is a hotbed for innovation.…

As a violinist, I can't stress enough how crucial a top-notch case is in the…