Delaware Statutory Trusts1

Delaware Statutory Trusts, or DSTs, aren’t just for investors in Delaware. DSTs are trusts that allow individuals to co-invest in direct real estate properties. One of the primary benefits that DSTs provide is the ability for investors to have a stake in these assets without actually having to hold or manage them. Buying into a DST gives investors fractional ownership of real estate investments without the hassle of toilets, tenants and other managerial responsibilities that come along with owning property. All the while, investors are reaping the benefits of their investments in the form of issuances from the operation of the trust, rental income and the eventual sale of the property.

DST properties can come in many forms and each with their own unique selling points. Some popular property types include:

● Multifamily residential buildings

● Multi-tenant retail properties

● Self-storage facilities

● Industrial properties

● Multi-tenant office buildings

What are the benefits of a DST?

DSTs are a great option for residents that live in high tax states, such as California. Besides the obvious tax benefits, DSTs provide investors with relative affordability compared to other real estate ventures and easy-to-understand deadlines and transactions. Here are just a few reasons Californians might consider choosing a DST:

1. Investing in a DST can be easier than buying individual properties. Despite low housing inventory, real estate investing has become a modern-day gold rush. Many property owners on the West Coast are selling their properties at record high prices, making it harder to be a buyer these days. DST investing offers a solution for individuals to be involved in direct real estate investing without having to do the due diligence on the properties themselves. Rather, the property managers will have completed the inspections, environmental impact reports and other managerial tasks associated with maintaining a property, leaving the investor with more time on their hands.

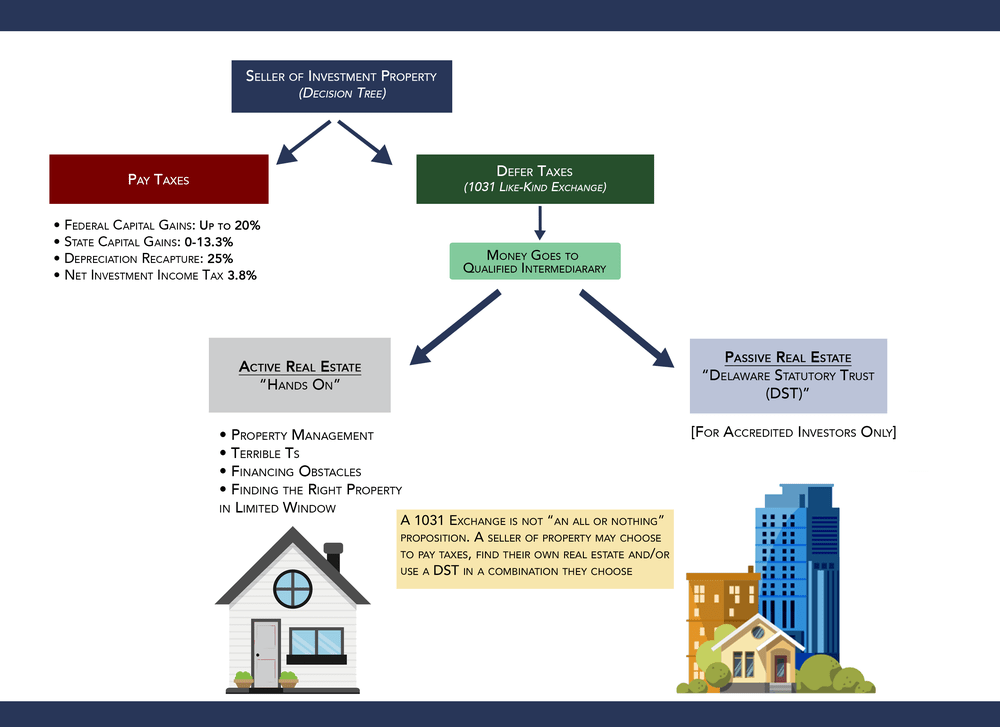

2. Offer 1031 Exchange Eligibility. DSTs are especially useful when paired with a 1031 exchange. 1031 exchanges are a property swapping tool that allows individuals to buy and sell rental properties while deferring capital gains, as long as the proceeds from the sale are reinvested into a “like-kind” property. The IRS has a provision that allows for investors to utilize their DST as one of the three replacement rental property options in a 1031 exchange, offering individuals the chance to potentially swap out their existing property for any number of “like-kind” DST properties. The variability of property types that can be exchanged is attractive in a large state like California, where a variety of industries, from farmers to technology companies, call home. Examples of a “like-kind” exchange are:

● Exchanging any type of business property for another, including farmland, raw land, rental property, industrial buildings, retail rental spaces and residential rental property.

● Exchanging property in one state for property in another state.

● Exchanging one large property for three smaller properties that add up to equivalent or greater value.

By utilizing a DST in the 1031 exchange, investors will continue to defer their capital gains taxes on the sale of the first property. In states like California where the state capital gains tax is high, doing a 1031 exchange can save the investor money by putting off that tax burden, potentially indefinitely.

3. DSTs provide high-quality, investment-grade properties and portfolio diversification. It’s not just the residential real estate market that’s booming in California, commercial real estate has been a hotbed of activity as well. Purchasing real estate through a DST means only purchasing a fraction of the property ownership, which means diversifying your portfolio is now cheaper and easier than ever. This lower entry cost allows individuals to invest in one or multiple DSTs and provides exposure throughout many different industries. When making any investment, it’s important to understand potential risks. For example, investors should think about the lack of control, market fluctuation, management risks, and liquidity.

With some of the highest capital gains tax rates in the nation, Californians should consider whether taking advantage of the tax incentives that DSTs offer makes sense for them. While an underutilized tool, DSTs in combination with 1031 exchanges can provide accredited investors with a tax deferral and real estate exposure in their portfolios. Because DSTs are formulated like a trust, they offer liability protection similar to that of a limited liability company or partnership, allowing for the greatest investor protection. However, DSTs aren’t for everyone.

It’s important for individuals to do their research before making an investment decision. If you’re interested in learning more about the tax advantages of DSTs, as well as the pros and cons of 1031 exchanges, you can learn more on our website at https://www.1031crowdfunding.com/.

Author Edward Fernandez is CEO and founder of 1031 Crowdfunding.

This material does not constitute an offer to sell or a solicitation of an offer to buy any security. An offer can only be made by a prospectus that contains more complete information on risks, management fees and other expenses. This literature must be accompanied by, and read in conjunction with, a prospectus or private placement memorandum to fully understand the implications and risks of the offering of securities to which it relates. As with all investing, investing in private placements are speculative in nature and involve a degree of risk, including loss of your principal. Past performance is not necessarily indicative of future results and forward-looking statements and projections are not guaranteed to achieve the results described and your actual returns may vary significantly. Investments in private placements are illiquid in nature and there may be no secondary market or ability to sell the investment should the need for liquidity arise. This material should not be construed as tax advice and you should consult with your tax advisor as individual tax situations will vary. Securities offered through Capulent, LLC, member FINRA, SIPC.

Innam Dustgir's journey from freelancing to becoming the CEO of three highly successful IT companies…

California has a big vision for the future of clean energy. This year, renewable energy…

The loss of a tooth can affect more than just your smile—it can impede on…

Imagine a young mother of two suddenly loses her husband in a tragic accident. The…

California, known for its diverse economy and thriving tech industry, is a hotbed for innovation.…

As a violinist, I can't stress enough how crucial a top-notch case is in the…