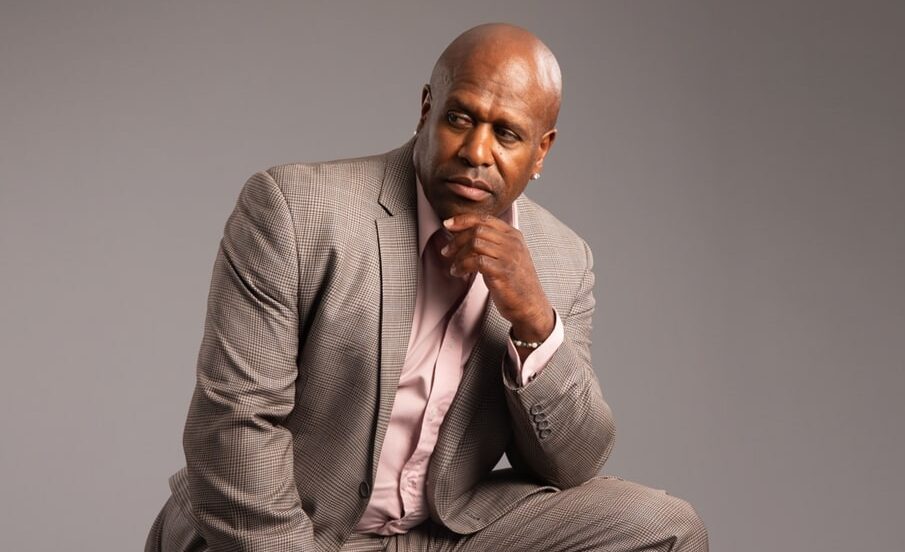

As 2020 winds down, there is a huge sigh of relief because just about everyone has had their fill of this year’s crazy twists and turns. However, on the other hand, some people are starting to get that nervous, anxious feeling as they compile records for their tax preparation. Glenn Sandler, founder and CEO of G.I. Tax Service, has made it his business to take the fear out of tax season, even in challenging times like these.

After taking a significant hit from COVID-19, struggling businesses are dreading the thought of losing even more to taxes. Sandler and G.I. Tax Service are always committed to their motto, “leave no dime behind.” But 2020 has made this saying even more pertinent, and Sandler wants these businesses to know he’s more determined than ever to stand behind his company motto.

Understanding the QBI.

Sandler helps businesses get their footing and not let paying their taxes do more damage than necessary by making sure they know all of the relevant deductions that are available. One such deduction is the Qualified Business Income (QBI) deduction.

The Qualified Business Income (QBI) deduction, also known as Section 199A, allows eligible taxpayers to deduct up to 20-percent of their qualified business income, plus 20-percent of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. This deduction is available to both taxpayers who itemize costs on a Schedule A and those who take a standard deduction.

Since this deduction is relatively new, Sandler explains many taxpayers may have questions concerning their eligibility, and many may not know about it at all. However, the QBI has been available since 2017 and can be a significant saving for businesses that meet its specifications.

Sandler adds that your business’s designation changes how you are taxed corporately and how these taxes affect you personally. The details concerning this deduction can be defined further by seeking the services of a qualified CPA. Your business might not be able to receive this deduction; however, it can be a significant savings for those who do qualify.

Changing the face of tax preparation.

Other than taking the sting out of filing by helping people find every last deduction, Sandler and G.I. Tax have more practices that are changing the image of tax preparation.

Sandler and his team are not a “pop-up, in-and-out”, tax-preparation service. They have year-round accessibility to clients, who they treat as family. Sandler knows people have financial needs all year long, not just from January until April 15th. And their goal is to make the nerve-wracking, but necessary, process of filing your taxes as simple as possible.

But tax preparation is not their only specialty. G.I. Tax offers a variety of free services, including the following:

–Notary public

–Financial planning advice

–Credit counseling

–FAFSA application assistance

–Court financial statements

–Tax counseling

Sandler believes when people have the help they need to get through burdensome paperwork, they don’t dread the process. This is why G.I. Tax strives to serve its customers at a level above and beyond the competition. Glenn Sandler is hoping he’s changing the way people feel about doing the “hard stuff”. In fact, he’s hoping you’ll just leave all the “hard stuff” to G.I. Tax.