While the term "budget" is frequently linked with constrained expenditure, a budget need not be constrained for it to be effective.

A personal or household budget is a breakdown of your income and expenditure for a specific period, usually one month. While the term “budget” is frequently linked with constrained expenditure, a budget need not be constrained for it to be effective.

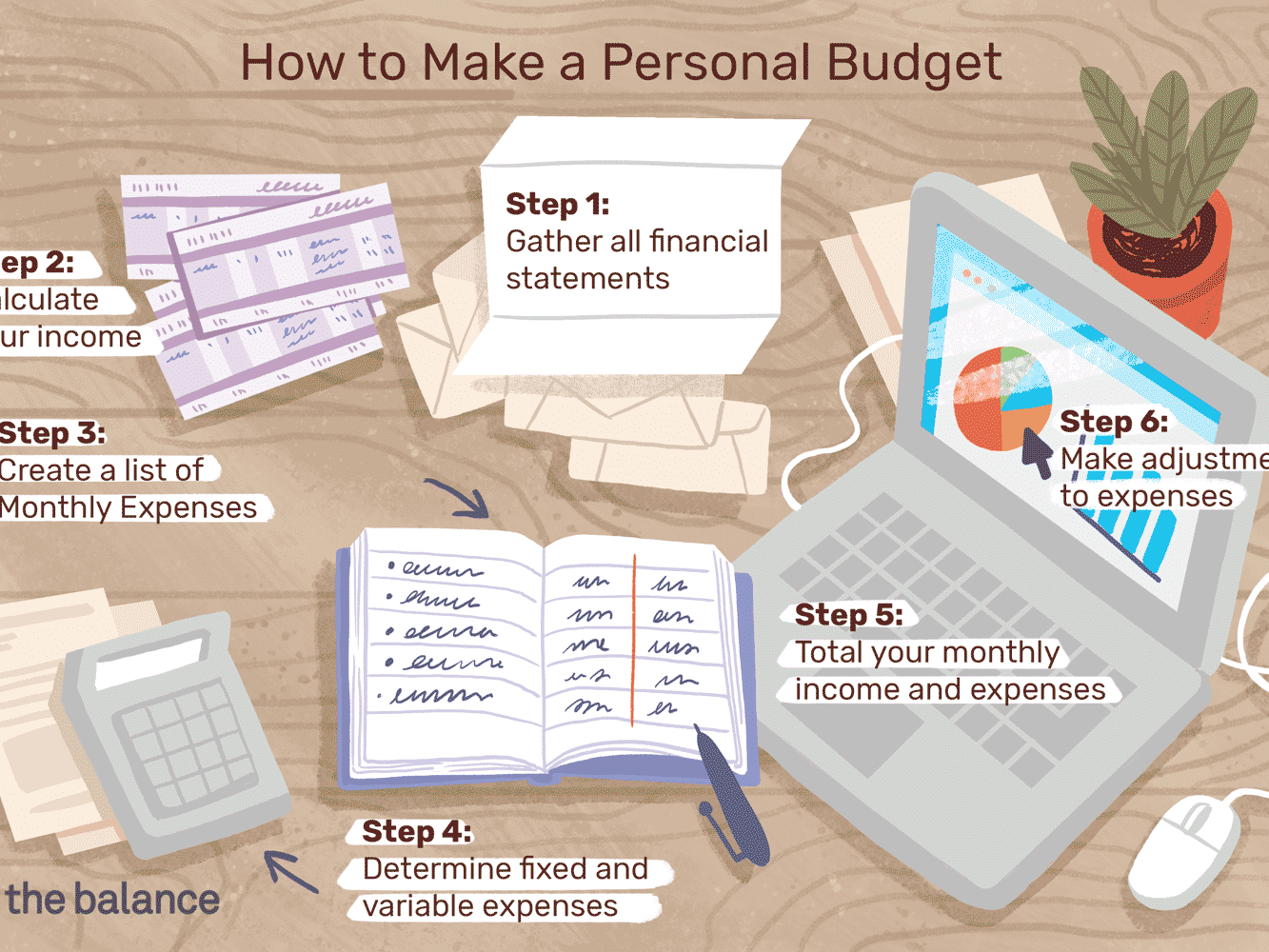

It will display how much money you plan to receive, your mandatory costs (like rent and insurance), and discretionary spending (like entertainment or eating out). Rather than seeing a budget as a hindrance, think of it as a tool for accomplishing your financial goals if you need to make a basic budget that you can stick to. Here are nine tips to consider:

Goals are an excellent place to start since they give you a reason to accomplish everything else. We all have enormous aspirations, but you must transform them into achievable objectives if you want them to start coming true. Begin by identifying one or two primary long-term goals for your life. What indeed strikes a chord with you and gets you pumped up by simply thinking about it?

Turn your primary long-term goals into SMART personal financial goals once you’ve identified them. A SMART goal has been broken down into something concrete and actionable, so you can start taking action right away. You’re defining what you need to accomplish to achieve your primary goal, which translates into what you need to do each month to achieve your big goal.

Your monthly income, as previously said, is the second most crucial aspect of your budget. In a single month, how much do you earn? Some people have it easy since they get paid monthly or bi-weekly. Assume your budget is based on four salaries if paid weekly. If you get an “extra” check, use it to cover unexpected costs, make additional debt payments, or contribute more to your savings account.

Your spending is the third component of a healthy budget. A budget must be based on the reality of your spending for it to operate, so start monitoring it. It is simple if all of your costs are paid for with a credit card or a bank card. You can quickly analyze your expenditures by pulling out recent bank and credit card statements. If you spend cash regularly, you’ll need to keep track of your receipts for a few months. Simply begin keeping receipts for anything you spend money on.

Create a beginning budget that works for you once you’ve saved up at least a couple of months’ worth of receipts. Begin by categorizing all of your spendings into categories that make sense to you. What grouped products should seem natural, so you know precisely where a cost will go when spending that money. Do this for every expense. Use a budgeting tool like a check stub maker to automate the process.

After you’ve categorized all of your spendings into manageable groupings, add them all up and divide by the number of months you’re looking at. Divide the sum of each category by three if you utilized three months of receipts and statements. The more months you use, the more accurately your budget will reflect an “average” month.

Now it’s time to make that “starting budget” work for you. You’ll want to add a new line or two for each of the objectives you established before. Decide on a tiny amount to donate to those objectives, and write it down. Subtract your entire income from the sum of all of your expenditure categories, including your goals. The resulting number may be negative. Don’t be concerned. That’s how much money you’ll have to shave from your budget, especially from your flexible spending areas.

How are you going to go about doing this? You must choose which areas of your life you can cut back on without making your life unbearable. You won’t keep to your budget if it makes your life difficult, and you’ll never get ahead. Evaluate each item on your list to know whether it contributes to your long-term satisfaction. If it does, then don’t worry about it, but if not, then you may need a budget cut. Set a goal for yourself in that department for the upcoming month.

It’s now time to take action! Changing your habits and routines is a vital part of budgeting properly. What categories did you eliminate? What are the new target categories you’ve added? Those are the ones that require immediate care. An excellent method for the cutback categories is to consider which spending in that area is unimportant to you. Which ones do not provide you with long-term happiness? Don’t get rid of the ones that make you happy for a long time.

A helpful criterion is to ask yourself if you’d be content with this spending if you looked back on it in a month. What expenses from a month ago now appear to be unnecessary? Those are some solid ones to start with. Work on developing new habits that will save you from incurring such costs, such as altering your commute or taking your lunch to work.

For one month, make adjustments. Take it on as a 30-day financial challenge. Sit down at the end of the month and assess how well you did. By categorizing your monthly spendings into groups, you can compare your actual expenses at the end of the month to your budget from the start. If you can maintain your new habit, repeat it until you reach your objectives.

If you prefer not to use pen and paper (or spreadsheets), it’s time to utilize an online budgeting tool like Check Stub Maker. You can set a budget and track your expenditures using remote tools from your smartphone. You may also sync your budget with your spouse, which is a great way to keep the lines of communication open.

You should take advantage of a check stub maker if you own a business. Employers use a pay stub generator to keep track of payroll information, employee earnings, and various other factors such as gross wages, taxes, deductions, and employer contributions. Employees use pay stubs for everything from making sure they’ve been paid accurately to demonstrating their income to lenders. In contrast, businesses use them to simplify their financial records and compute tax returns.

Pay Stubs are essential tools in a business owner’s toolbox since they play a vital part in calculating and managing employee remuneration. However, not everyone is familiar with the process of making a pay stub, and it’s more complicated than you may believe. Due to this, many people opt to generate pay stubs utilizing online check stub makers and then adjusting them to their company’s and employees’ unique needs.

Innam Dustgir's journey from freelancing to becoming the CEO of three highly successful IT companies…

California has a big vision for the future of clean energy. This year, renewable energy…

The loss of a tooth can affect more than just your smile—it can impede on…

Imagine a young mother of two suddenly loses her husband in a tragic accident. The…

California, known for its diverse economy and thriving tech industry, is a hotbed for innovation.…

As a violinist, I can't stress enough how crucial a top-notch case is in the…